AEPS Software

Start your own AEPS banking business with our complete white-label software solution. Support for all AEPS services including cash withdrawal, balance inquiry, and mini statements.

Start your own AEPS banking business with our complete white-label software solution. Support for all AEPS services including cash withdrawal, balance inquiry, and mini statements.

We support all Aadhaar Enabled Payment System services

Easy cash withdrawal using Aadhaar authentication

Instant bank balance checking with Aadhaar

Quick mini bank statements using Aadhaar

Aadhaar-based fund transfer between accounts

Secure fingerprint authentication for transactions

Aadhaar-linked mobile banking services

Complete solution to start your own AEPS banking business

Your branding, your domain name - completely white-labeled solution

Advanced security protocols and encryption for all transactions

Support for all major banks with AEPS services

Set different commission rates for various AEPS services

Comprehensive reports and analytics for business insights

Technical assistance for setup and ongoing operations

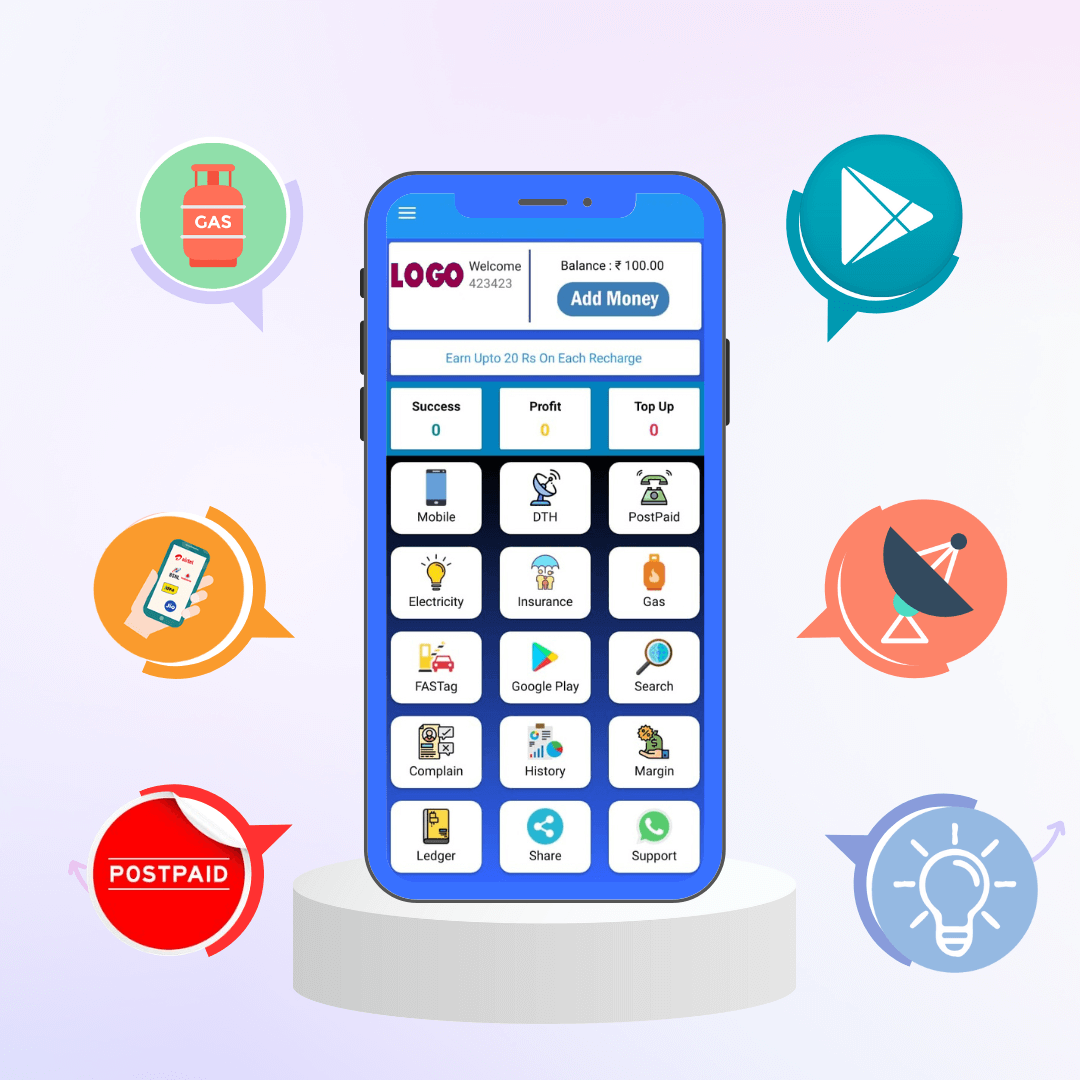

Feature-rich interface designed for optimal AEPS experience

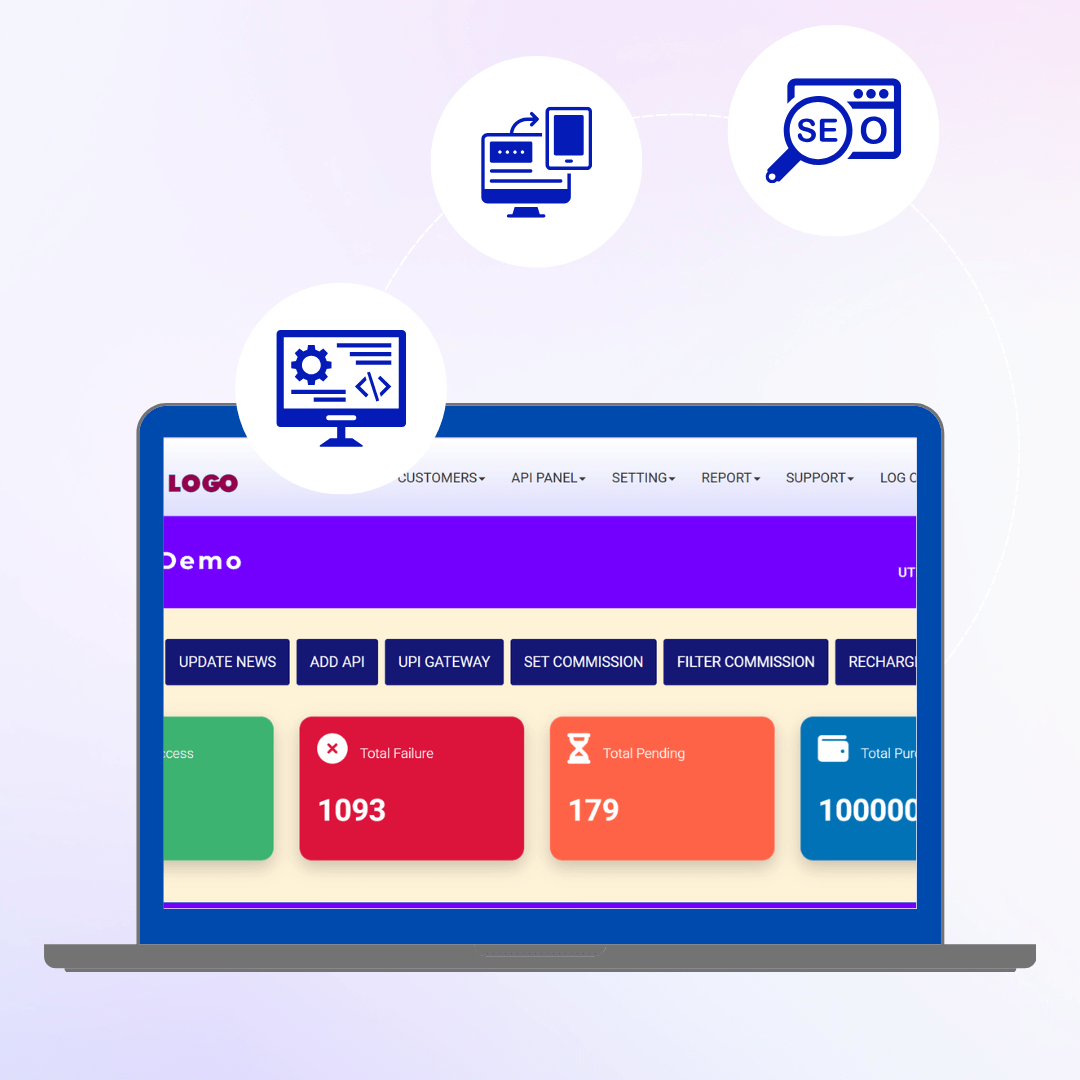

Complete control panel with transaction analytics

User-friendly AEPS transaction portal

Simple steps to start your AEPS banking business

Register and customize the software with your branding

Integrate with banking APIs and AEPS services

Begin offering AEPS services to your customers

Choose the plan that works best for your AEPS business

Perfect for small AEPS businesses

Ideal for growing AEPS businesses

For high-volume AEPS businesses

We integrate Banking APIs, NPCI AEPS, Biometric devices or any third party AEPS APIs at additional charges.

Need a Custom Plan? Contact UsSuccess stories from our satisfied customers

Request a free demo of our AEPS software today.

Everything you need to know about our AEPS software

Typically, we can set up your white-label AEPS software within 3-5 business days after payment confirmation. The exact time may vary based on the level of customization and banking API integration required.

Our AEPS software is designed to work with licensed banking correspondents and BC agents. You would typically need to partner with a licensed entity or obtain necessary approvals based on RBI guidelines. We can guide you through the process and connect you with our banking partners.

We support all UIDAI-certified biometric devices including Morpho, Mantra, Secugen, and other popular AEPS devices. Our software is compatible with most fingerprint scanners that meet NPCI standards for AEPS transactions.

We provide 24/7 technical support via phone, email, and WhatsApp. Our dedicated support team is always available to help you with any issues or questions you may have with AEPS services, including device integration, transaction issues, and banking API integration.

Commission rates vary by transaction type and volume, but typically range from 0.5% to 1.5% per transaction. Cash withdrawals usually offer higher commissions than balance inquiries. We offer competitive commissions in the industry. Contact us for detailed commission structure for AEPS services.

Our software uses bank-grade encryption, follows all RBI security guidelines, and is compliant with NPCI standards for AEPS transactions. We use secure APIs, encrypted data transmission, and regular security audits to ensure your customers' data is always protected.

Our support team is here to help you with any questions about our AEPS software

Contact Support